Post Office FD Scheme 2026: The Post Office FD Scheme 2026 continues to be a trusted savings option for Indian investors seeking safety and stable returns. As per the latest rates applicable in early 2026, the scheme offers interest between 6.90% and 7.50% per annum for deposit tenures ranging from 1 year to 5 years. A minimum investment of ₹1,000 is required, and the scheme is fully backed by the Government of India, ensuring capital security and guaranteed returns.

Post Office Fixed Deposits are part of the small savings schemes operated nationwide through India Post. These deposits are suitable for individuals who prefer low-risk investments over market-linked products. With quarterly compounding and annual interest payout, the Post Office FD Scheme 2026 remains competitive compared to many bank fixed deposits while offering unmatched reliability.

Post Office FD Scheme 2026

The Post Office FD Scheme is a fixed-income investment where an individual deposits a lump sum amount for a fixed period at predetermined interest rates. At the end of the tenure, the investor receives the principal along with accumulated interest.

This scheme is ideal for conservative investors, retirees, and those planning short to medium-term financial goals without exposure to market fluctuations.

Post Office FD Scheme 2026

| Feature | Details |

|---|---|

| Scheme Name | Post Office FD Scheme |

| Investment Year | 2026 |

| Deposit Tenure | 1, 2, 3, and 5 Years |

| Interest Rate Range | 6.90% – 7.50% p.a. |

| Minimum Deposit | ₹1,000 |

| Maximum Deposit | No upper limit |

| Compounding Method | Quarterly |

| Interest Payout | Annually |

| Tax Benefit | Available on 5-Year FD |

| Risk Level | Very Low |

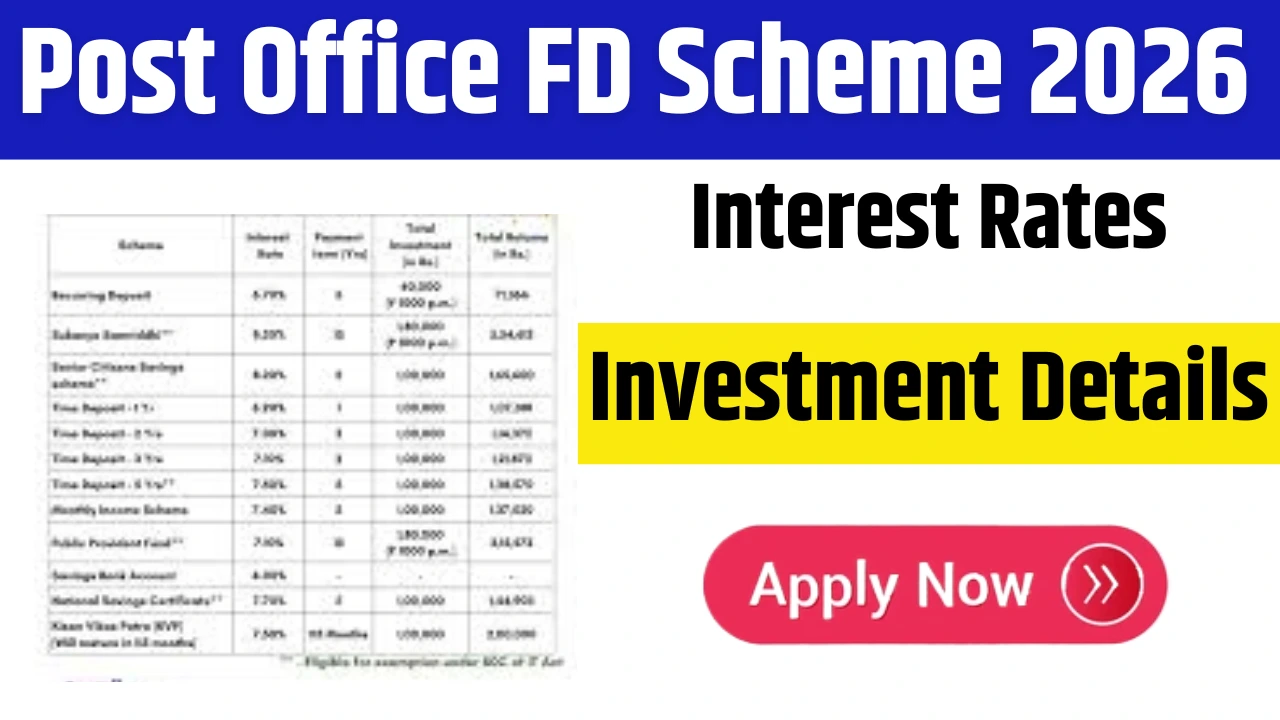

Latest Post Office FD Interest Rates 2026

The interest rates under the Post Office FD Scheme 2026 vary depending on the chosen tenure. Longer tenures generally offer higher returns.

- 1-Year Fixed Deposit: 6.90% per annum

- 2-Year Fixed Deposit: 7.00% per annum

- 3-Year Fixed Deposit: 7.10% per annum

- 5-Year Fixed Deposit: 7.50% per annum

These rates are reviewed periodically and are subject to revision by the government.

Who Should Invest in Post Office FD Scheme

The Post Office FD Scheme is suitable for a wide range of investors including salaried individuals, senior citizens, and small savers. Although there is no additional interest benefit for senior citizens, the scheme’s safety and guaranteed returns make it attractive.

People looking for predictable income and capital protection often choose Post Office Fixed Deposits over high-risk instruments.

Tax Rules on Post Office Fixed Deposits

Interest earned from Post Office FDs is taxable as per the investor’s applicable income tax slab. Tax is not deducted at source automatically, so investors must declare the interest income while filing returns.

The 5-year Post Office FD qualifies for tax deduction under Section 80C, making it a useful tool for tax planning.

Premature Withdrawal and Maturity Rules

Premature withdrawal is allowed after six months from the date of deposit. However, interest penalties apply depending on how early the deposit is closed.

At maturity, the deposit amount along with interest is credited to the investor, or it can be reinvested by opting for renewal.

Advantages of Post Office FD Scheme 2026

The scheme offers several benefits that make it a preferred choice:

- Government-backed security with zero market risk

- Suitable for long-term and tax-saving investment planning

Its simplicity and nationwide availability further add to its appeal.

FAQs – Post Office FD Scheme 2026:

Q1. What is the minimum amount required to open a Post Office FD?

The minimum investment required is ₹1,000.

Q2. Is the Post Office FD Scheme safe?

Yes, it is fully backed by the Government of India and considered very safe.

Q3. Can I withdraw my FD before maturity?

Yes, premature withdrawal is allowed after six months with applicable penalties.

Conclusion

The Post Office FD Scheme 2026 remains a dependable investment option for individuals seeking stable returns without risk. With competitive interest rates, flexible tenures, and government backing, it serves as an excellent savings instrument for both short-term and long-term financial goals. Investors who value security, predictable income, and simplicity will continue to find Post Office Fixed Deposits a reliable choice in 2026.